Three things to take away

What is the outlook for the Canadian manufacturing sector – and how is the geopolitical and economic landscape impacting growth

What are the major risk areas for manufacturing firms in 2024

What can Canadian firms do to mitigate risk, address skills shortages and promote growth

Volatile macroeconomic and geopolitical conditions present growing challenges for the Canadian manufacturing sector. Inflation brought a rapid tightening of monetary conditions, which is likely to dampen both economic activity and manufacturing demand into 2024.

Nonetheless, opportunities abound for the sector. Increasing US competition with China is driving reshoring and supply chain integration throughout North America. Concerns over climate change have caused both the US and Canada to pass fiscal incentives for clean energy technologies, presenting major opportunities for Canadian manufacturers.

What is the outlook for the Canadian manufacturing sector – and how is the geopolitical and economic landscape impacting growth

What are the major risk areas for manufacturing firms in 2024

What can Canadian firms do to mitigate risk, address skills shortages and promote growth

Volatile macroeconomic and geopolitical conditions present growing challenges for the Canadian manufacturing sector. Inflation brought a rapid tightening of monetary conditions, which is likely to dampen both economic activity and manufacturing demand into 2024.

Nonetheless, opportunities abound for the sector. Increasing US competition with China is driving reshoring and supply chain integration throughout North America. Concerns over climate change have caused both the US and Canada to pass fiscal incentives for clean energy technologies, presenting major opportunities for Canadian manufacturers.

Introduction

Volatile macroeconomic and geopolitical conditions present growing challenges for the Canadian manufacturing sector. Inflation brought a rapid tightening of monetary conditions, which is likely to dampen both economic activity and manufacturing demand into 2024. While economic conditions are expected to improve in 2025, they can easily be derailed by external shocks such as an asset price crash, further monetary tightening, or geopolitical convulsions in the Taiwan Strait. Elections in both Canada - the 45th Canadian federal election will take place by October 2025 - and the United States in the coming year or two, may bring further swings in policy direction, creating regulatory whiplash and uncertainty for companies.

Nonetheless, opportunities abound for the sector. Increasing US competition with China is driving reshoring and supply chain integration throughout North America. Concerns over climate change have caused both the US and Canada to pass fiscal incentives for clean energy technologies, presenting major opportunities for Canadian manufacturers of batteries, vehicles, semiconductors, and more. The adoption of artificial intelligence (AI) is likely to increase the sector’s productivity and alleviate challenges from labour shortages. These factors will serve to benefit the manufacturing sector over the next several years.

Volatile macroeconomic and geopolitical conditions present growing challenges for the Canadian manufacturing sector. Inflation brought a rapid tightening of monetary conditions, which is likely to dampen both economic activity and manufacturing demand into 2024. While economic conditions are expected to improve in 2025, they can easily be derailed by external shocks such as an asset price crash, further monetary tightening, or geopolitical convulsions in the Taiwan Strait. Elections in both Canada - the 45th Canadian federal election will take place by October 2025 - and the United States in the coming year or two, may bring further swings in policy direction, creating regulatory whiplash and uncertainty for companies.

Nonetheless, opportunities abound for the sector. Increasing US competition with China is driving reshoring and supply chain integration throughout North America. Concerns over climate change have caused both the US and Canada to pass fiscal incentives for clean energy technologies, presenting major opportunities for Canadian manufacturers of batteries, vehicles, semiconductors, and more. The adoption of artificial intelligence (AI) is likely to increase the sector’s productivity and alleviate challenges from labour shortages. These factors will serve to benefit the manufacturing sector over the next several years.

Canada’s manufacturing sector

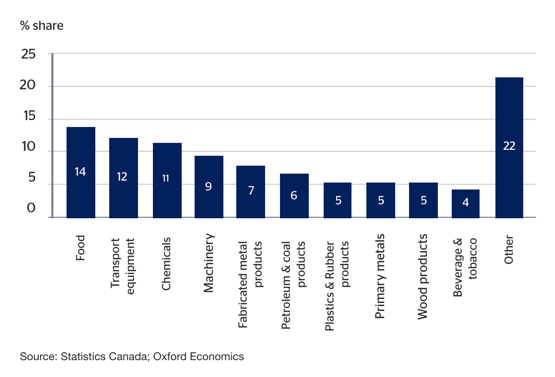

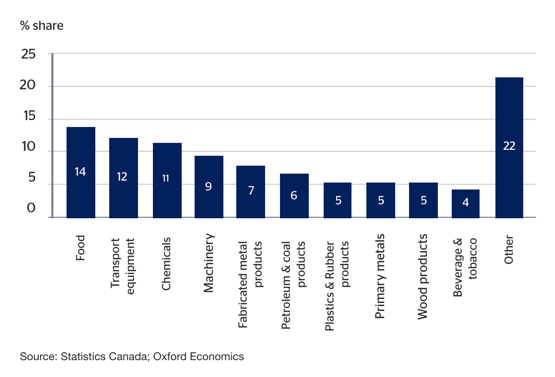

In 2022, Canada’s manufacturing sector generated a $195 billion Gross Value Added (GVA) contribution to Canadian Gross Domestic Product (GDP).1 This was 9% of the economy’s total output. The food manufacturing sector made the largest contribution, producing 14% of the manufacturing sector’s contribution to GDP. Manufacturers of transport equipment followed, with a 12% share, and chemicals with 11% (Fig. 1). Geographically, most production is concentrated in Ontario, Quebec, and Alberta with a collective share of over 80% of manufacturing output.2

In 2022, the sector employed 1.7 million workers, which represented 9% of all employment in Canada. Over the last 10 years the share of employment and GDP that manufacturing contributes to the economy has declined. Manufacturing in Canada has been outpaced by the growth in the services sector and the natural resources sector. Within manufacturing, the largest growing sectors include machinery manufacturing, and electrical equipment and components.

1. All dollar amounts are Canadian dollars unless otherwise stated.

2. Bank of Canada. 2023. "Business Outlook Survey - data by sector (four-quarter moving averages)".

Fig 1: Largest 10 sectors’ share of manufacturing contribution to GDP in 2022

In 2022, Canada’s manufacturing sector generated a $195 billion Gross Value Added (GVA) contribution to Canadian Gross Domestic Product (GDP).1 This was 9% of the economy’s total output. The food manufacturing sector made the largest contribution, producing 14% of the manufacturing sector’s contribution to GDP. Manufacturers of transport equipment followed, with a 12% share, and chemicals with 11% (Fig. 1). Geographically, most production is concentrated in Ontario, Quebec, and Alberta with a collective share of over 80% of manufacturing output.2

In 2022, the sector employed 1.7 million workers, which represented 9% of all employment in Canada. Over the last 10 years the share of employment and GDP that manufacturing contributes to the economy has declined. Manufacturing in Canada has been outpaced by the growth in the services sector and the natural resources sector. Within manufacturing, the largest growing sectors include machinery manufacturing, and electrical equipment and components.

1. All dollar amounts are Canadian dollars unless otherwise stated.

2. Bank of Canada. 2023. "Business Outlook Survey - data by sector (four-quarter moving averages)".

Fig 1: Largest 10 sectors’ share of manufacturing contribution to GDP in 2022

Economic challenges facing the manufacturing sector

The Bank of Canada increased its policy rate from 0.25% at the start of 2022 to 5% in November 2023. This has influenced the interest rates banks charge manufacturers with flexible rate loans, making servicing those debts significantly more expensive. For those firms with fixed rate loans, the worst is yet to come.

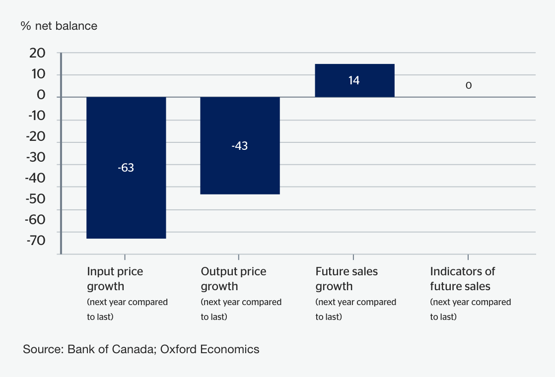

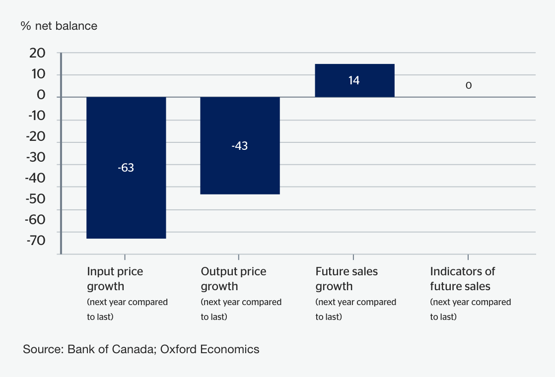

The tighter monetary policy has begun to dampen demand, favourably impacting the outlook for an ease in inflation. The Bank of Canada Business Outlook Survey for Q3 2023 suggests that a net balance of 63% of the manufacturing firms surveyed expect their input prices to grow at a slower rate over the next year than over the past year (Fig. 2). Canadian manufacturers felt this would feed into lower output price inflation going forward with a net balance of 43% of manufacturing firms expecting the prices they charged for their products to increase at a slower rate over the next year than the past year. Manufacturers which have not been able to maintain the profit margins with elevated input price inflation in recent years will therefore face a challenge. It will likely become more difficult to push through price increases in the immediate future.

Manufacturing firms perceived the outlook for demand for their goods to be relatively weak.3 A net balance of 14% of firms thought the rate of increase in their sales volume over the next year was expected to be higher than last year’s rate.

3. Bank of Canada. 2023. "Business Outlook Survey - data by sector (four-quarter moving averages)".

However, when asked what indicators for future sales (such as order books and enquiries) looked like, survey participants responded they were above last year’s level in equal numbers to those who responded they were below.

Fig 2. Manufacturers’ perceptions of the future in the Q3 2023 Bank of Canada Business Outlook Survey

The Bank of Canada increased its policy rate from 0.25% at the start of 2022 to 5% in November 2023. This has influenced the interest rates banks charge manufacturers with flexible rate loans, making servicing those debts significantly more expensive. For those firms with fixed rate loans, the worst is yet to come.

The tighter monetary policy has begun to dampen demand, favourably impacting the outlook for an ease in inflation. The Bank of Canada Business Outlook Survey for Q3 2023 suggests that a net balance of 63% of the manufacturing firms surveyed expect their input prices to grow at a slower rate over the next year than over the past year (Fig. 2). Canadian manufacturers felt this would feed into lower output price inflation going forward with a net balance of 43% of manufacturing firms expecting the prices they charged for their products to increase at a slower rate over the next year than the past year. Manufacturers which have not been able to maintain the profit margins with elevated input price inflation in recent years will therefore face a challenge. It will likely become more difficult to push through price increases in the immediate future.

Manufacturing firms perceived the outlook for demand for their goods to be relatively weak.3 A net balance of 14% of firms thought the rate of increase in their sales volume over the next year was expected to be higher than last year’s rate.

3. Bank of Canada. 2023. "Business Outlook Survey - data by sector (four-quarter moving averages)".

However, when asked what indicators for future sales (such as order books and enquiries) looked like, survey participants responded they were above last year’s level in equal numbers to those who responded they were below.

Fig 2. Manufacturers’ perceptions of the future in the Q3 2023 Bank of Canada Business Outlook Survey

Key things to watch

- International trade opportunities and challenges: Despite ongoing trade disputes over dairy, automobiles, and softwood lumber, Canadian and US officials have been encouraging the nearshoring and integration of critical supply chains, including essential minerals, battery production, and semiconductors. This push is largely driven by deteriorating Canada-China and US-China relations. Canadian officials have called for the decoupling of key economic sectors from China as relations become increasingly strained. The US has adopted industrial policy measures to limit US reliance on China for semiconductors and other important technologies. While Canada-China trade has come under increased national security scrutiny, Canadian manufacturers stand to benefit from US industrial policy and reshoring efforts.

- Climate policies: The federal government seeks to reduce emissions by 40% of 2005 levels by 2030 and has pledged to reach net zero by 2050. In recent years, Ottawa has passed a carbon pricing regime (known commonly as the carbon tax), an environmental impact assessment law, and is moving to introduce further clean energy regulations and restrictions on emissions from oil and gas. These laws place compliance burdens on manufacturers and have increased pressure on companies to reduce their emissions. Many of these environmental laws are likely to be overturned or adjusted in the coming years from court challenges by provincial governments and by an expected Conservative government – the Conservative party is well positioned to win elections slated for 2025 at the latest.

On a related note, the government has recently passed fiscal incentives for clean energy technologies to maintain competitiveness with the US. Manufacturers will be able to take advantage of these incentives, which will likely attract investment primarily to automotive and battery manufacturers. One such incentive, the Clean Technology Investment Tax Credit, provides a 30% refundable tax credit for zero-emission electricity generation equipment, electricity storage equipment, and electric vehicles. This will enable manufacturers to lower their emissions by investing in clean capital equipment at a reduced cost.

- International trade opportunities and challenges: Despite ongoing trade disputes over dairy, automobiles, and softwood lumber, Canadian and US officials have been encouraging the nearshoring and integration of critical supply chains, including essential minerals, battery production, and semiconductors. This push is largely driven by deteriorating Canada-China and US-China relations. Canadian officials have called for the decoupling of key economic sectors from China as relations become increasingly strained. The US has adopted industrial policy measures to limit US reliance on China for semiconductors and other important technologies. While Canada-China trade has come under increased national security scrutiny, Canadian manufacturers stand to benefit from US industrial policy and reshoring efforts.

- Climate policies: The federal government seeks to reduce emissions by 40% of 2005 levels by 2030 and has pledged to reach net zero by 2050. In recent years, Ottawa has passed a carbon pricing regime (known commonly as the carbon tax), an environmental impact assessment law, and is moving to introduce further clean energy regulations and restrictions on emissions from oil and gas. These laws place compliance burdens on manufacturers and have increased pressure on companies to reduce their emissions. Many of these environmental laws are likely to be overturned or adjusted in the coming years from court challenges by provincial governments and by an expected Conservative government – the Conservative party is well positioned to win elections slated for 2025 at the latest.

On a related note, the government has recently passed fiscal incentives for clean energy technologies to maintain competitiveness with the US. Manufacturers will be able to take advantage of these incentives, which will likely attract investment primarily to automotive and battery manufacturers. One such incentive, the Clean Technology Investment Tax Credit, provides a 30% refundable tax credit for zero-emission electricity generation equipment, electricity storage equipment, and electric vehicles. This will enable manufacturers to lower their emissions by investing in clean capital equipment at a reduced cost.

- Adoption of AI: Canadian manufacturers have been increasingly turning to AI to optimize production processes. The push to adopt emerging technologies will be accelerated in the coming years. The Canadian Manufacturers & Exporters (CME) industry association has launched Industrie 2030, an initiative aimed at doubling Canadian manufacturing output and exports by 2030 and establish Canada as a “world leader” in the development, adoption, and commercialization of advanced manufacturing technologies. AI can be used to alleviate labour shortages, reducing the need for human capital through generating product design options, forecasting the price of commodities and raw materials, conducting quality assurance, and automating monotonous operations. The technology is likely to increase manufacturing productivity.

- Labour challenges: Many industries have faced a labour shortage for the last several years, although this has eased slightly in recent months. In Q3 2023, 32% of manufacturers said that a shortage of labour restricted their ability to meet demand.4 In the 2022 CME labour survey, 62% of the 563 manufacturers surveyed said they lost or turned down contracts due to a lack of workers, amounting to a $7.2 billion loss in sales. A lack of skilled workers also impedes investment in advanced technologies, harming productivity.

4. Bank of Canada. 2023. "Business Outlook Survey - data by sector (four-quarter moving averages)"

- Adoption of AI: Canadian manufacturers have been increasingly turning to AI to optimize production processes. The push to adopt emerging technologies will be accelerated in the coming years. The Canadian Manufacturers & Exporters (CME) industry association has launched Industrie 2030, an initiative aimed at doubling Canadian manufacturing output and exports by 2030 and establish Canada as a “world leader” in the development, adoption, and commercialization of advanced manufacturing technologies. AI can be used to alleviate labour shortages, reducing the need for human capital through generating product design options, forecasting the price of commodities and raw materials, conducting quality assurance, and automating monotonous operations. The technology is likely to increase manufacturing productivity.

- Labour challenges: Many industries have faced a labour shortage for the last several years, although this has eased slightly in recent months. In Q3 2023, 32% of manufacturers said that a shortage of labour restricted their ability to meet demand.4 In the 2022 CME labour survey, 62% of the 563 manufacturers surveyed said they lost or turned down contracts due to a lack of workers, amounting to a $7.2 billion loss in sales. A lack of skilled workers also impedes investment in advanced technologies, harming productivity.

4. Bank of Canada. 2023. "Business Outlook Survey - data by sector (four-quarter moving averages)"

Macroeconomic risks to the manufacturing sector

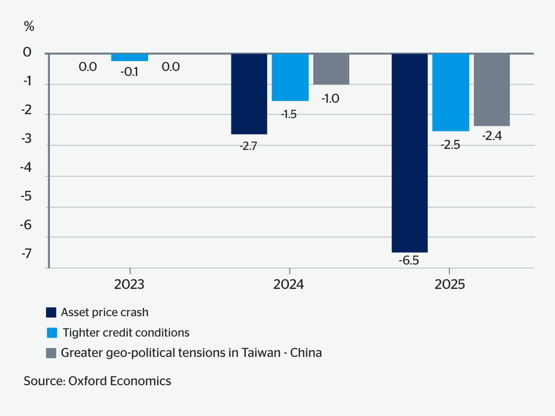

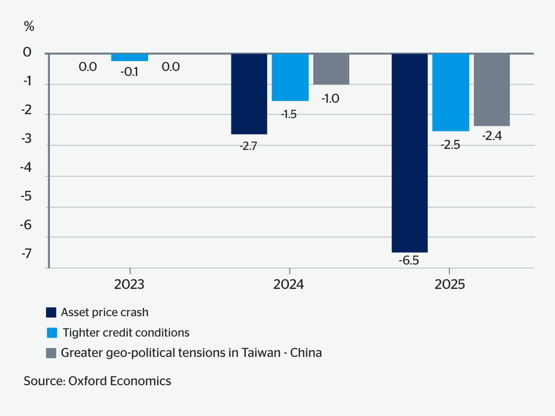

Oxford Economics’ central forecast is for slow-moving growth in manufacturing output, well below the 4.3% growth seen in 2022. GVA is projected to increase by 1% in 2023, and 1.1% in 2024.5,6 As the economy gathers momentum in 2025, the growth rate is predicted to increase to 3.7%. Growth in 2023 is driven by the motor vehicles and parts sector which is forecast to grow by 16%, while 2024’s growth will be driven by the metal products sector with a forecast growth rate of 2.8%. For 2025, growth in the sector is forecast to be steered by strong growth in mechanical engineering with a growth rate of 6.1%.

Economic forecasting is notoriously difficult. It is subject to errors that arise from unforeseen shocks and changes in economic behaviour. We have therefore explored three scenarios to present possible downside risks to the manufacturing sector in the short term.7

Firstly, there is a risk of an asset price crash from high interest rates triggering a sharp fall in stock markets and house prices – and thus tighter consumption. In this scenario, manufacturing is negatively impacted with GVA lower by 2.7% in 2024 relative to the baseline and 6.6% lower in 2025. Another scenario involves tighter credit conditions in which lenders restrict the volume of lending and raise the rates of interest they charge. In this scenario Canada’s manufacturing sector also sees a decline relative to the baseline forecast of 0.1% in 2023, 1.5% in 2024, and 2.5% in 2025. In a third scenario, increased tensions between China and Taiwan will have global ramifications. We model that escalations between China and Taiwan would negatively impact manufacturing relative to the baseline with output 1.0% lower in 2024 and 2.4% lower in 2025.

5. Oxford Economics. Global Industry Service. Accessed November 2023.

6. Part of the sluggishness in manufacturing growth in 2024 reflects temporary shutdowns for retooling, for example to electric vehicles at Ford and Stellantis.

7. Oxford Economics. Global Scenarios Service. Accessed November 2023.

In 2024, growth will be driven by the metal products sector with a forecast growth rate of 2.8%.

Fig 3: Percentage difference from the baseline forecast of manufacturing Gross Value Added under different macroeconomic scenarios

Oxford Economics’ central forecast is for slow-moving growth in manufacturing output, well below the 4.3% growth seen in 2022. GVA is projected to increase by 1% in 2023, and 1.1% in 2024.5,6 As the economy gathers momentum in 2025, the growth rate is predicted to increase to 3.7%. Growth in 2023 is driven by the motor vehicles and parts sector which is forecast to grow by 16%, while 2024’s growth will be driven by the metal products sector with a forecast growth rate of 2.8%. For 2025, growth in the sector is forecast to be steered by strong growth in mechanical engineering with a growth rate of 6.1%.

Economic forecasting is notoriously difficult. It is subject to errors that arise from unforeseen shocks and changes in economic behaviour. We have therefore explored three scenarios to present possible downside risks to the manufacturing sector in the short term.7

Firstly, there is a risk of an asset price crash from high interest rates triggering a sharp fall in stock markets and house prices – and thus tighter consumption. In this scenario, manufacturing is negatively impacted with GVA lower by 2.7% in 2024 relative to the baseline and 6.6% lower in 2025. Another scenario involves tighter credit conditions in which lenders restrict the volume of lending and raise the rates of interest they charge. In this scenario Canada’s manufacturing sector also sees a decline relative to the baseline forecast of 0.1% in 2023, 1.5% in 2024, and 2.5% in 2025. In a third scenario, increased tensions between China and Taiwan will have global ramifications. We model that escalations between China and Taiwan would negatively impact manufacturing relative to the baseline with output 1.0% lower in 2024 and 2.4% lower in 2025.

5. Oxford Economics. Global Industry Service. Accessed November 2023.

6. Part of the sluggishness in manufacturing growth in 2024 reflects temporary shutdowns for retooling, for example to electric vehicles at Ford and Stellantis.

7. Oxford Economics. Global Scenarios Service. Accessed November 2023.

In 2024, growth will be driven by the metal products sector with a forecast growth rate of 2.8%.

Fig 3: Percentage difference from the baseline forecast of manufacturing Gross Value Added under different macroeconomic scenarios

Advice for business

Elevated interest rates have increased borrowing costs for many manufacturers and the speed and extent to which the Bank of Canada is likely to reduce its policy interest rate is uncertain. Those firms looking to invest may want to think more widely about the sources of capital available to them. It would be judicious to get external advice and to think of alternative sources of capital in addition to banks with which firms have existing relations.

Because 76% of Canada’s merchandised exports were sold to the United States in 2022, exporting manufacturers should be aware of developments in the US economy. They should pay particular attention to fluctuations in the exchange rate of the Canadian vs US dollar and to potential changes in trade policy from future US administrations. If a manufacturer is heavily or solely dependent on customers in the US, they should consider mitigation techniques, such as currency hedging, and in the longer term they should diversify their customer base as a way to lower risk.

Finally, 32% of manufacturing firms reported facing shortages of labour that restricted their ability to meet demand.8 Skills shortages were also perceived to be a constraint on productivity-boosting investment in other survey evidence: the Canadian Manufacturers & Exporters annual survey found that a lack of skilled workers was the third largest obstacle (33%) preventing businesses from investing in more advanced technologies.9

8. Bank of Canada. 2023. "Business Outlook Survey - data by sector (four-quarter moving averages)".

9. Canadian Manufacturers & Exporters. 2023. CME 2023 Technology Adoption Survey.

With the expected downturn in the Canadian economy, and the unemployment rate predicted to rise from an average of 5.6% in 2023 to 7.1% in 2024, some employers might find it easier to fill up their vacancies.

Long term, manufacturers must cast a wide net for talent, including among high school, college, and university graduates. Firms should also try to attract people from diverse backgrounds. Investing in upskilling and reskilling new and existing employees through training will help fill roles that are difficult to recruit for. Lastly, continuously monitoring the benefits packages offered elsewhere will ensure a firm’s financial offer is competitive.

In 2024, manufacturing’s contribution to Canadian GDP is projected to grow relatively slowly by 1.1%. But thereafter the sector’s prospects are more optimistic. Reshoring and decoupling of supply chains from China may benefit some Canadian manufacturers. The government incentives to switch to cleaner technology will provide some with a way to renew their capital equipment at reduced cost. AI will likely revolutionize the production process. Those trends offer exciting opportunities.

Elevated interest rates have increased borrowing costs for many manufacturers and the speed and extent to which the Bank of Canada is likely to reduce its policy interest rate is uncertain. Those firms looking to invest may want to think more widely about the sources of capital available to them. It would be judicious to get external advice and to think of alternative sources of capital in addition to banks with which firms have existing relations.

Because 76% of Canada’s merchandised exports were sold to the United States in 2022, exporting manufacturers should be aware of developments in the US economy. They should pay particular attention to fluctuations in the exchange rate of the Canadian vs US dollar and to potential changes in trade policy from future US administrations. If a manufacturer is heavily or solely dependent on customers in the US, they should consider mitigation techniques, such as currency hedging, and in the longer term they should diversify their customer base as a way to lower risk.

Finally, 32% of manufacturing firms reported facing shortages of labour that restricted their ability to meet demand.8 Skills shortages were also perceived to be a constraint on productivity-boosting investment in other survey evidence: the Canadian Manufacturers & Exporters annual survey found that a lack of skilled workers was the third largest obstacle (33%) preventing businesses from investing in more advanced technologies.9

8. Bank of Canada. 2023. "Business Outlook Survey - data by sector (four-quarter moving averages)".

9. Canadian Manufacturers & Exporters. 2023. CME 2023 Technology Adoption Survey.

With the expected downturn in the Canadian economy, and the unemployment rate predicted to rise from an average of 5.6% in 2023 to 7.1% in 2024, some employers might find it easier to fill up their vacancies.

Long term, manufacturers must cast a wide net for talent, including among high school, college, and university graduates. Firms should also try to attract people from diverse backgrounds. Investing in upskilling and reskilling new and existing employees through training will help fill roles that are difficult to recruit for. Lastly, continuously monitoring the benefits packages offered elsewhere will ensure a firm’s financial offer is competitive.

In 2024, manufacturing’s contribution to Canadian GDP is projected to grow relatively slowly by 1.1%. But thereafter the sector’s prospects are more optimistic. Reshoring and decoupling of supply chains from China may benefit some Canadian manufacturers. The government incentives to switch to cleaner technology will provide some with a way to renew their capital equipment at reduced cost. AI will likely revolutionize the production process. Those trends offer exciting opportunities.

This report has been developed for QBE by Control Risks and Oxford Economics

This report has been developed for QBE by Control Risks and Oxford Economics

Building Supply Chain Resilience

Understand and manage risk in your supply chain

Sign-up to be notified about future articles from the Sector Resilience Series, and other thoughts, reports or insights from QBE.