- Faced with shortages of skilled labor, businesses need to invest in training

- Artificial Intelligence (AI) is expected to increase manufacturing productivity

- Food is the largest contributor to Canadian manufacturing, but machinery and electrical equipment experience the biggest growth

Manufacturing’s contribution to the Canadian economy is expected to increase relatively slowly by 1.1% this year, mainly driven by the metal products sector, according to the latest QBE report.

Inflation has brought a rapid tightening of monetary conditions, which is likely to dampen manufacturing demand into 2024. Still, opportunities abound for the manufacturing sector, most of them linked to the reshoring of North American supply chains, fiscal incentives for clean energy technologies and potential Artificial Intelligence (AI) applications.

Manufacturing accounts for 9% of Canadian GDP and employment but is being outpaced

Over the last 10 years, the share of employment and Gross Domestic Product (GDP) that manufacturing contributes to the Canadian economy has declined. It has been outpaced by the growth in the services sector and the natural resources sector.

Still, in 2022, manufacturing generated a $195 billion Gross Value Added (GVA) contribution to Canadian GDP, which was 9% of the economy’s total output. The sector employed 1.7 million workers, which represented 9% of all employment in Canada.

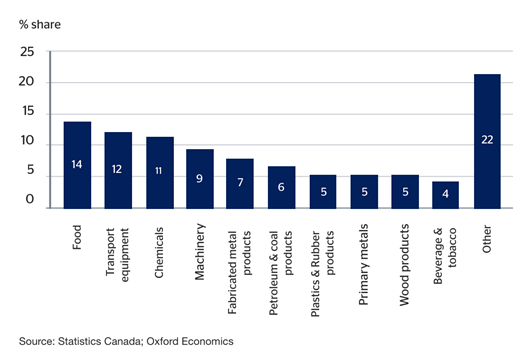

Within manufacturing, the largest contributions came from:

- food manufacturing (14% of the manufacturing sector’s contribution to GDP)

- transport equipment (12%)

- chemicals (11%)

- machinery (9%)

- metal products (7%)

Also within manufacturing, the largest growing sectors include machinery manufacturing, and electrical equipment and components.

After a 1% growth in 2023 driven by motor vehicles and parts (with a sector growth of 16%), manufacturing GVA is projected to increase by 1.1% in 2024 and 3.7% in 2025. This growth will be driven by the metal products sector (+2.8% in 2024) and mechanical engineering (+6.1% in 2025).

|

Annual growth rates of fastest growing manufacturing sectors |

2023 |

2024 |

2025 |

|

Transportation equipment manufacturing |

12% |

0% |

5% |

|

Primary metal manufacturing |

0% |

0% |

5% |

|

Fabricated metal product manufacturing |

4% |

5% |

5% |

|

Machinery manufacturing |

5% |

-3% |

7% |

|

Electrical equipment, appliance & component manufacturing |

8% |

2% |

3% |

|

Computer & electronic product manufacturing |

1% |

3% |

4% |

Key factors to watch

- Canada and the United States have been encouraging nearshoring, amid deteriorating relations with China. Despite ongoing trade disputes between the two North American neighbors over dairy, automobiles, and softwood lumber, there is a push to integrate critical supply chains across the continent, including essential minerals, battery production, and semiconductors.

- Manufacturers will be able to take advantage of fiscal incentives passed by the federal government such as the Clean Technology Investment Tax Credit, which provides a 30% refundable tax credit for zero-emission electricity generation equipment, electricity storage equipment, and electric vehicles. This will likely attract investment primarily to automotive and battery manufacturers. However, environmental laws like the carbon tax might be overturned or adjusted in the coming years, following court challenges by provincial governments and an expected Conservative win at the next federal elections, slated for October 2025 at the latest.

- A third of manufacturers (32% in Q3 2023) say that a shortage of labour restricts their ability to meet demand. And a lack of skilled workers is the third largest obstacle preventing businesses from investing in more advanced technologies.

- Artificial Intelligence is likely to increase manufacturing productivity. Canadian manufacturers have been increasingly turning to AI to optimize production processes and this trend is expected to accelerate in the coming years. The Canadian Manufacturers & Exporters (CME) industry association has launched Industrie 2030, an initiative aimed at establishing Canada as a ‘world leader’ in the adoption of advanced manufacturing technologies.

Ben Hunter, director of QBE Canada, comments:

“The manufacturing sector has some exciting prospects for those businesses who strike the right balance between investing in people and investing in technologies. Artificial Intelligence will have a momentous impact on the sector’s productivity, so now is the right time for human intelligence to step in and harness it. A key element will be to train people with the skills they need to make the most of new technologies. Businesses who do that will gain a competitive edge.”

Advice for manufacturing businesses

- Elevated interest rates have increased borrowing costs for many manufacturers. Those firms looking to invest may want to think of alternative sources of capital in addition to banks with which they have existing relations.

- Exporting manufacturers should pay attention to fluctuations in the exchange rate of the Canadian vs US dollar and to potential changes in US trade policy. Canadian manufacturers heavily dependent on US customers should consider currency hedging, and customer base diversification.

- Manufacturers must cast a wide net for talent among high school, college, and university graduates to attract people from diverse backgrounds. They need to invest in training to upskill new and existing employees.

Compiled by Oxford Economics and Control Risks, the detailed report on Canadian manufacturing is available in the QBE Canada document library.